Table of Content

Twenty-one states and Washington, DC, require that an attorney oversees the real estate closing. Seller closing costs include fees that are paid to lenders and third parties. The calculator’s default setting offers estimates for many of the closing costs. If you know the cost for an item, enter it in the calculator to improve the results. In some instances, lenders will offer to pay your closing costs or roll them into your loan as a last resort.

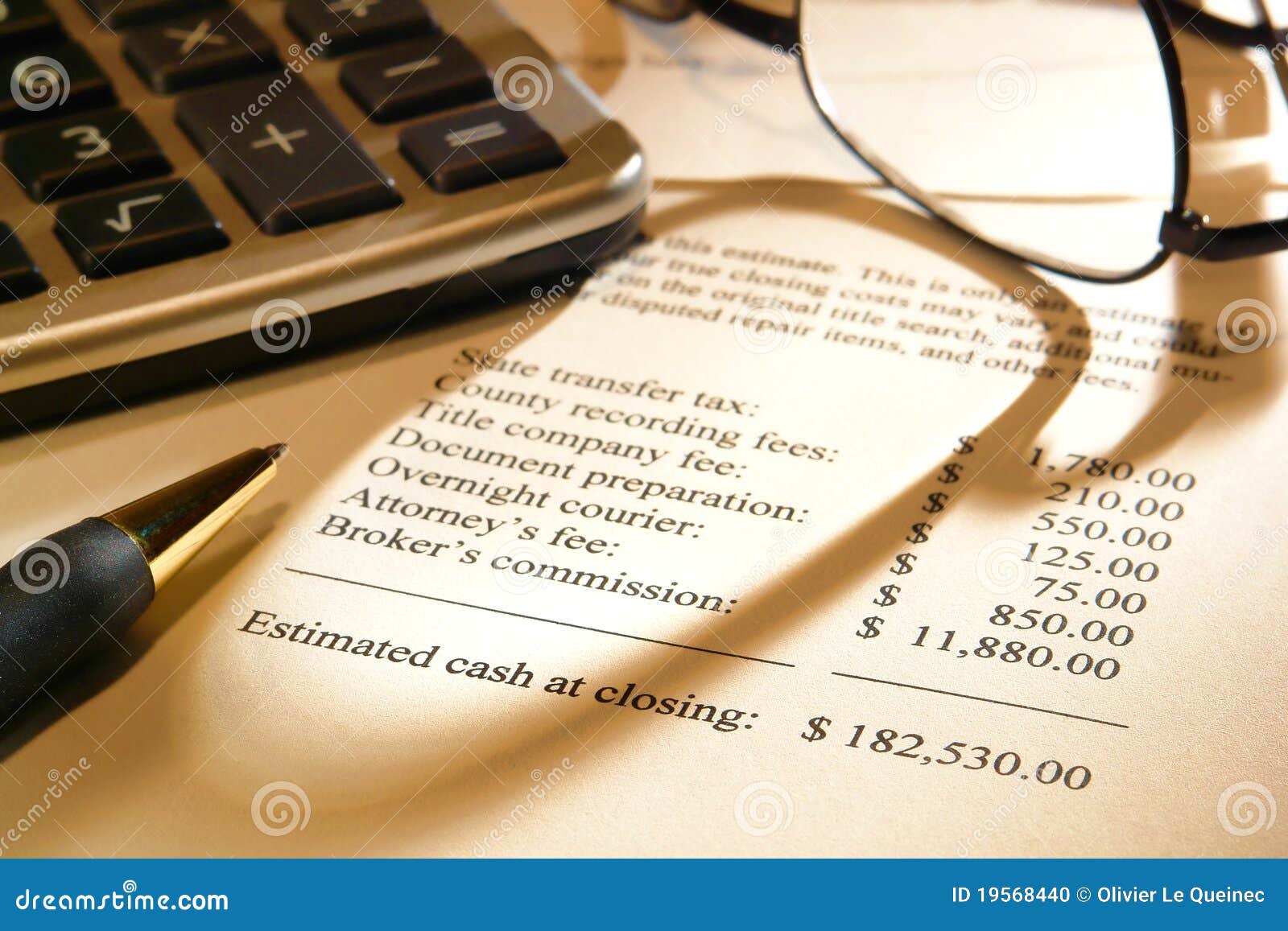

The biggest fees that home sellers pay are real estate agent fees, which typically run 5-6% of the sales price. Other, smaller fees can include attorney fees, HOA fees, recording fees and escrow fees. Learn more about seller fees and other closing costs when selling a house.

Who pays closing costs — the buyer or the seller?

When you roll your closing costs into your loan, you will pay more for your mortgage. If you have a VA Loan, this fee, charged as a percentage of the loan amount, helps offset the program’s costs to U.S. taxpayers. The amount of the fee depends on your military service classification and loan amount; the fee can be paid at closing or rolled into your mortgage. Points are an optional, upfront payment to the lender to reduce the interest rate on your loan and thereby lower your monthly payment. At a time when mortgage interest rates are already low, paying points might not save you much money. Because a lender can’t lend you any more than the home is worth, a seller may actually benefit if you don’t offer more because you’re lowering the risk of the deal falling through later on.

At closing, you may also make your first HOA dues payment, prorated based on your closing date. This does not occur on all loans during underwriting, but sometimes the initial report occurred in the month prior to closing, and your lender may require a more recent report. The amount a seller can cover in buyer closing cost is capped at 6% of the home sale price. Buyer closing costs are usually between 2% to 5% of the home’s purchase price.

One-time fees

Buyer closing costs can add 2% to 4% of the purchase price of the home. The biggest fee you’ll pay is real estate commission — at 5–6% of the sale price, realtor fees account for more than half of your estimated seller closing costs. Real estate closing costs are fees that home buyers and sellers pay to complete a real estate transaction — in addition to the sales price of the home and the mortgage down payment.

If you buy a home without an agent, remember to write into your offer letter that you’re proposing a lower rate in exchange for no agent commission. Credit reporting fees cover the cost of pulling your credit report and looking at your credit score. It can be offering to pay points on the loan or providing a home warranty.

Closing fee

If you buy a home without an agent and don’t tell the seller when you make the offer, the seller’s agent may pocket the extra money. For a first-time VA user, if you put down less than 5% on your loan, your VA funding fee is equal to 2.3% of your total loan value or 3.6% if it’s a subsequent use. A 5% down payment lowers your fee to 1.65%, and a 10% down payment lowers your fee to 1.4%. The last two are the same regardless of whether it’s your first time or your 10th. Your lender might ask you to pay any interest that accrues on your loan between closing and the date of your first mortgage payment upfront.

For sellers, closing costs can add up to 8–10% of the home sale price — on top of repaying any debts or liens related to a property. Everything in a real estate transaction is negotiable, and that includes closing costs. Average closing costs for sellers add up to 8-10% of the sale price. But how much closing costs you'll actually pay depends on the laws and conventions in your local municipality, as well as what you negotiate with the buyer or seller. Include deposits to start your escrow account, which will be used to cover property taxes, home insurance and, if applicable, private mortgage insurance. Typically you'll deposit enough money to cover two months of these costs.

Seller closing costs

Most mortgage lenders require you to have at least a certain amount of homeowners insurance as a condition of your loan to cover damage. You have the option of also getting protection for the contents within your home and liability coverage if someone gets injured on your property. If your home is on or near a flood plain, you may need to pay $15 – $25 for a flood certification. This money goes to the Federal Emergency Management Agency, which uses the data to plan ahead for emergencies and to target high-risk zones. This closing cost only applies if you’re buying a house in a flood zone or you.

Yes, the buyer can pay the seller’s closing costs, if both parties agree to this while negotiating a purchase agreement. Commission is the single largest closing cost paid by sellers—so reducing it is the easiest way to slash your total closing costs and save money. Commission is all the money a buyer’s agent makes from a sale, so if you don't offer a buyer’s agent commission, they’ll likely steer their clients to homes that do. In that sense, you’re not covering your buyer’s tab — you paid the buyer’s agent to bring a serious, qualified buyer to your listing. Closing costs are due when you close on the sale of your home — the final step before you hand over the keys to the buyer.

Connect with a lending specialist, or learn more about programs offered by Bank of America. A fee charged by a lender to cover certain processing expenses in connection with making a mortgage loan. Bank of America offers several options to help lower your down payment or other closing costs. Connect with a lending specialist or learn more about programs offered by Bank of America. In some areas, it's customary for the seller to pay for the owner's policy.

Title insurance costs an average of 0.5 – 1% of the purchase price. Some costs are lender requirements, some are government requirements and others may be optional, depending on the situation. What you’ll need to pay for will depend on where you live, your specific lender and what type of loan you take. Let’s say that you take out a conventional loan worth $200,000.

Closing costs are an extremely important aspect of real estate that home buyers must prepare for, but who pays them? In short, buyer and seller closing costs are paid based on the terms of the home purchase contract, which both mortgage parties agree on. As a rule, the buyer’s closing costs are substantial, but the seller is often responsible for some closing fees as well. Average closing costs are typically between 3% and 6% of the loan balance, so you should prepare to include that into your budget when house hunting. Be sure to also ask your lender and real estate agent about your area’s property taxes and any additional fees required by the state.

No comments:

Post a Comment